Creating a monthly budget for a family of four can seem daunting, but with careful planning and attention to detail, it can be a straightforward process. A well-structured budget ensures that all essential expenses are covered, allows for savings, and helps to avoid unnecessary debt. Here’s a step-by-step guide to help you get started.

How to Create a Monthly Budget for a Family of Four

Step 1: Calculate Your Total Income

The first step in creating a budget is to know how much money is coming in each month. This includes:

- Salaries and wages: Include all take-home pay after taxes and other deductions.

- Other sources of income: This could be rental income, freelance work, investments, or any government benefits.

Add all these amounts together to get your total monthly income.

Step 2: List All Monthly Expenses

Next, list out all your monthly expenses. It’s helpful to categorize these into fixed and variable expenses.

Fixed Expenses

These are the expenses that stay the same every month:

- Mortgage or rent

- Utilities (electricity, water, gas)

- Internet and phone bills

- Insurance (health, car, home)

- Loan payments (car, student loans, personal loans)

- Childcare or education expenses

Variable Expenses

These expenses can vary each month:

- Groceries

- Transportation (gas, public transit)

- Entertainment and dining out

- Clothing

- Medical expenses not covered by insurance

- Miscellaneous expenses

Step 3: Track Your Spending

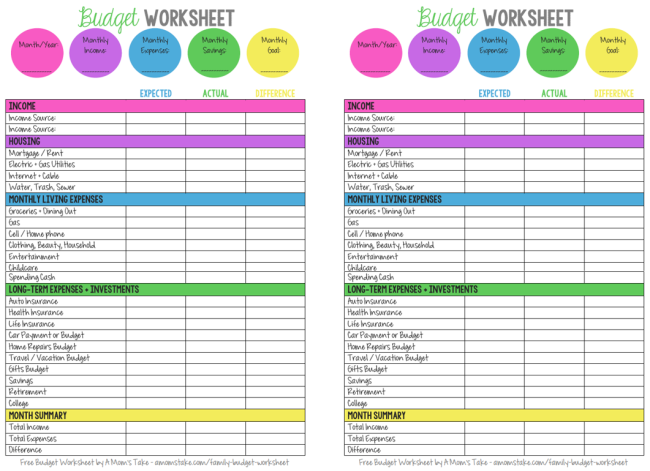

For a month or two, track every dollar spent to get an accurate picture of where your money is going. Use apps, spreadsheets, or even a simple notebook to record each expenditure. This will help identify areas where you might be overspending.

Step 4: Set Financial Goals

Determine what you want to achieve with your budget. These goals might include:

- Building an emergency fund

- Saving for a family vacation

- Paying off debt

- Saving for college funds

- Retirement savings

Having clear goals will give you motivation and direction as you manage your budget.

Step 5: Create the Budget

Now that you have your income, expenses, and goals laid out, it’s time to create your budget. Here’s how:

- Allocate funds for fixed expenses first. These are your non-negotiable expenses.

- Budget for variable expenses. Based on your tracked spending, allocate realistic amounts for groceries, transportation, etc.

- Set aside money for savings and goals. Aim to save at least 10-20% of your income if possible.

- Plan for irregular expenses. These might include car repairs, medical bills, or holidays. Setting aside a small amount each month in a separate fund can help manage these costs.

Step 6: Review and Adjust Regularly

A budget is not a set-it-and-forget-it tool. Review your budget at least once a month:

- Compare your actual spending to your budgeted amounts. Identify areas where you overspent or underspent.

- Adjust categories as necessary. If you find you consistently spend more on groceries than planned, increase that category and reduce another.

- Revisit your goals. Make sure you’re on track to meet your financial goals.

Step 7: Involve the Whole Family

Budgeting for a family is a team effort. Involve your partner and even your children in the process. This can help everyone understand the importance of sticking to the budget and contribute to achieving your financial goals.

Tips for Successful Budgeting

- Use budgeting tools: There are many apps and software available that can make budgeting easier and more efficient.

- Cut unnecessary expenses: Review your spending habits and find areas where you can cut back, like subscriptions you no longer use or dining out less frequently.

- Build an emergency fund: Aim to save 3-6 months’ worth of expenses in case of unexpected events like job loss or medical emergencies.

- Stay flexible: Life happens, and sometimes expenses can’t be predicted. Be willing to adjust your budget as needed.

How to plan a family monthly budget?

How to Plan a Family Monthly Budget

Creating a family budget is a crucial step towards financial stability and achieving your family’s goals. Here’s a step-by-step guide:

1. Track Your Income and Expenses

- List all income sources: This includes salaries, part-time jobs, child support, and any other regular income.

- Categorize expenses: Divide your expenses into fixed (rent, mortgage, utilities) and variable (groceries, entertainment, transportation).

- Use budgeting tools: Utilize spreadsheets, budgeting apps, or even pen and paper to track your spending.

2. Set Financial Goals

- Short-term goals: Consider building an emergency fund, saving for a vacation, or paying off small debts.

- Long-term goals: Focus on saving for retirement, children’s education, or a down payment on a house.

3. Allocate Your Income

- 50/30/20 rule: A popular method is to allocate 50% of income to needs, 30% to wants, and 20% to savings.

- Customize: Adjust these percentages based on your family’s specific needs and goals.

- Prioritize savings: Make saving a non-negotiable part of your budget.

4. Create a Realistic Budget

- Be honest: Don’t underestimate your expenses.

- Include everything: Account for all income and expenses, including hidden costs.

- Review regularly: Adjust your budget as needed to reflect changes in income or expenses.

5. Involve Your Family

- Open communication: Discuss financial goals and priorities as a family.

- Assign responsibilities: Divide budgeting tasks among family members.

- Celebrate successes: Recognize and reward progress towards financial goals.

6. Find Ways to Save

- Cut back on expenses: Identify areas where you can reduce spending without sacrificing quality of life.

- Cook at home: Prepare meals at home instead of eating out frequently.

- Shop smart: Use coupons, compare prices, and look for discounts.

- Find free or low-cost activities: Explore free entertainment options and hobbies.

Additional Tips

- Automate savings: Set up automatic transfers to your savings account.

- Build an emergency fund: Aim to save 3-6 months’ worth of living expenses.

- Review your budget regularly: Make adjustments as needed to stay on track.

- Use budgeting apps: Explore apps to help you track expenses and stay organized.

Remember: Creating a budget is a journey, not a destination. Be patient, persistent, and flexible. With time and effort, you can achieve your financial goals and build a secure future for your family.

Would you like to use a budgeting template or explore specific budgeting methods in more detail?